How to Streamline Accounts Payable and Accounts Receivable Automation

Discover how automating Accounts Payable and Accounts Receivable in the digital age streamlines operations, ensures accuracy, and optimizes cash flow for businesses.

In the digital age, businesses everywhere are looking to make operations more efficient, cut down on mistakes, and improve performance. Financial departments, which often deal with a lot of paperwork and manual tasks, are no different. Because they play a key role in keeping a company financially healthy, there's growing interest in automating Accounts Payable (AP) and Accounts Receivable (AR). This automation speeds up transactions and ensures they're accurate, something every financial executive wants.

What Is Accounts Payable?

Accounts Payable (AP) is like the list of bills a business needs to pay. It's the money you owe suppliers for things you've received but haven't paid for yet. Managing AP is really important. Paying on time and accurately helps you keep a good relationship with suppliers, avoid extra fees, and maintain your company's good credit. A well-managed AP system also helps you control your cash flow, which lets you plan investments and take advantage of any discounts for early payment.

What Is Accounts Receivable?

Accounts Receivable (AR) is the money that customers owe your business for goods or services you've provided. When you sell something and haven't been paid yet, that amount goes into AR. It's basically the money you're waiting to collect, and it's really important for your business. Good AR management makes sure you have a steady flow of cash coming in. This is crucial for running your business, paying your suppliers, and growing. A well-run AR system can also flag customers who are late on payments, helping you manage credit risks.

What Does a Typical AP Workflow Look Like?

Managing Accounts Payable, at its core, is a multi-step process ensuring businesses fulfill their payment obligations accurately and timely. A typical AP workflow can be dissected as follows:

Receiving Invoices: This is the initial phase where the business receives an invoice from the supplier, either physically or electronically.

Extracting Data: Upon receiving the invoice, pertinent details like supplier name, invoice number, date, line items, totals, and terms need to be extracted. This step traditionally involves manual data entry, a tedious process with room for errors.

Storing in an Accounting System: The data is input into the company's accounting or Enterprise Resource Planning (ERP) system after extraction. This central storage ensures that every invoice is accounted for and payments are scheduled per the terms.

Audit/Report: Once stored, periodic audits or reviews are essential. This ensures that the data entered matches the original invoice, discrepancies are highlighted, and necessary amendments are made. This step is pivotal for financial integrity and preparing reports for stakeholders.

The traditional AP workflow, though systematic, is labor-intensive and prone to errors, especially when managed manually. In the era of technological advancements, automation offers a revolutionary solution, making this process efficient, accurate, and hassle-free.

What Are the Problems of Non-automated AP and AR Management?

The adage "time is money" couldn't be more accurate when discussing non-automated Accounts Payable and Accounts Receivable management. In a world dominated by digital prowess, clinging to traditional methods of AP and AR management presents an array of challenges:

1. Manual Data Entry Errors

Human errors are inevitable. Whether entering the wrong amount, miscategorizing an invoice, or duplicating entries, these mistakes can lead to financial discrepancies, which are time-consuming and costly.

2. Time-Consuming Processes

Manual data entry, physical verification of invoices against purchase orders, and chasing late payments demand significant manpower and hours, slowing down the entire financial cycle.

3. Delayed Payments

With a non-automated system, keeping track of all outstanding invoices and their due dates becomes daunting. This can lead to unintentional delays, resulting in late payment penalties or strained vendor relationships.

4. Lack of Real-Time Insight

Traditional methods must provide an instantaneous overview of financial standings. Companies often wait for monthly or quarterly closes to gauge their financial health, challenging proactive decision-making.

5. Higher Operational Costs

Employing resources for manual data entry, verification, and follow-ups increases overhead costs. These funds could be better allocated to growth-centric activities or technological investments.

Benefits of AP and AR Automation

Embracing automation in AP and AR management is akin to setting a domino effect of efficiency, accuracy, and strategic advantages. Here's why businesses are rapidly moving towards automated systems:

Reduced Errors

Automated systems drastically minimize human errors. They can cross-verify invoice details, amounts, and other critical data points, ensuring accurate financial records.

Time and Cost Efficiency

Automation fast-tracks the AP and AR processes. Businesses can allocate resources more strategically instead of spending hours on manual entries and verifications. This not only reduces operational costs but also accelerates the financial cycle.

Enhanced Cash Flow Management

With an automated system, businesses get real-time insights into their payables and receivables, aiding in better cash flow management. Predictable cash flow is critical for operational sustainability and growth.

Strengthened Supplier and Customer Relations

Automation ensures timely supplier payments and customer reminders, fostering trust and healthy business relationships.

Scalability

As businesses grow, the volume of invoices and receivables multiplies. Automated systems easily adapt to increased workloads without compromising efficiency, allowing businesses to scale without hitches.

Data-Driven Decisions

Modern automation tools offer analytics and insights. Financial leaders can leverage this data to spot trends, forecast, and make informed, strategic decisions.

Automating AP and AR isn't just a cost-saving initiative; it's a strategic move, setting businesses on a trajectory for enhanced financial health, improved relationships, and sustained growth.

How to Automate Both AP and AR Using an AI Tool?

Automation for accounts payable and accounts receivable has evolved from being a nice-to-have to a must-have in today's business world. Leveraging AI-powered tools like Parsio can dramatically boost a business's efficiency, accuracy, and financial savvy. Dive into how Parsio is revolutionizing the landscape of AP and AR automation.

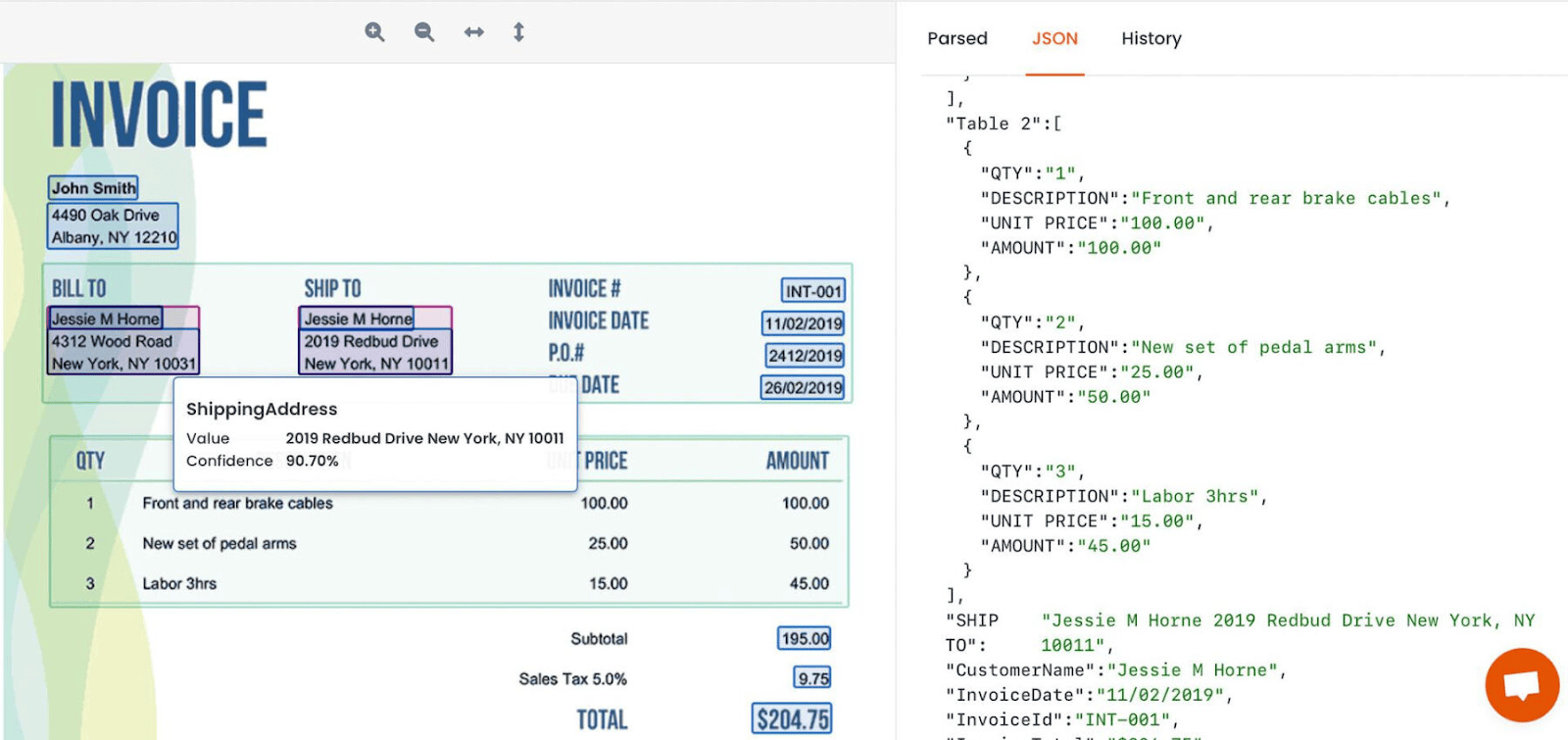

Parsio: Using AI for Financial Document Processing

Emerging from the growing need for sophisticated automation, Parsio harnesses the power of artificial intelligence to simplify accounts payable and accounts receivable processes. Featuring cutting-edge algorithms and a user-friendly interface, Parsio analyzes financial documents with unparalleled accuracy. This ensures that businesses have access to real-time, error-free data when they need it most.

Key Features of Parsio

Seamless Data Extraction

Parsio's AI seamlessly extracts critical information from PDF files such as invoices, receipts, and other financial documents, minimizing manual data entry.

Advanced OCR Technology

Even scanned, handwritten, or photographed documents are easy to be processed. Parsio's Optical Character Recognition (OCR) ensures that data is captured regardless of format and complexity.

Multilingual Support

With a global business landscape, Parsio understands documents in multiple languages, ensuring seamless operations across borders.

Intelligent Data Verification

The AI cross-checks extracted data with predefined rules or databases, ensuring validation at every step.

Integration Capabilities

Parsio isn't a standalone tool; it offers integration with popular accounting systems, CRMs, and spreadsheets, providing an interconnected financial ecosystem.

Security

Data integrity and security are paramount. Parsio employs top-tier security protocols, ensuring your financial data remains confidential and secure.

How to Use Parsio for AP & AR Automation?

- Sign Up & Set Up: Begin by logging into Parsio and creating a new mailbox. The intuitive interface will guide you through a seamless setup process, tailoring the platform to your business's needs.

- Document Upload: Upload your financial documents – invoices, receipts, or other AR/AP-related documents. You can either email your documents to Parsio address, upload them manually, or use our API for bulk import.

- Automated Data Extraction: Once uploaded, Parsio's AI jumps into action, extracting all pertinent data from the documents.

- Integration & Export: After verification, you can integrate Parsio with your existing accounting system or export the data to spreadsheets or other applications using automation platforms such Zapier, Make, Integrately, etc.

Incorporating Parsio into your AP and AR workflows means waving goodbye to manual errors, delays, and inefficiencies. It's a step towards a smarter, more informed, efficient financial future.

In Conclusion: Simplify AP and AR Management with Automation

Accounts payable and accounts receivable management are pillars of financial stability and efficiency within a business. They encompass processes that are both essential and time-consuming. In a traditional setting, managing these accounts has been fraught with challenges, ranging from human errors to delays, inefficiencies, and a significant investment in labor.

However, the advent of automation in these processes has been nothing short of a transformation. Businesses can use cutting-edge technology to streamline their AP and AR workflows, ensure greater accuracy, enhance transparency, and reallocate human resources to more value-driven tasks.

Specifically, AI tools like Parsio are revolutionizing how we approach these financial tasks:

Efficiency and Speed: Automation drastically cuts down the processing time, allowing businesses to handle more transactions without a proportional increase in manpower.

Accuracy and Compliance: Automated tools minimize human error and ensure that all processing adheres to legal and regulatory requirements.

Cost-Effectiveness: By reducing the need for extensive human intervention, automation leads to significant cost savings.

Scalability: Automation tools can quickly adapt to the growing needs of a business, making them a sustainable solution for both small and large enterprises.

Integration and Analytics: Advanced features allow seamless integration with existing systems and provide insightful analytics to guide strategic decisions.

In a global economy increasingly driven by data, automation in accounts payable and accounts receivable is not just an innovation; it is a necessity. Tools like Parsio stand at the intersection of technology and finance, offering a pathway to a future where financial management is not a tedious chore but a strategic asset.

As businesses continue to evolve and embrace the digital landscape, the automation of AP and AR will undoubtedly play a central role in shaping how organizations manage their finances. It is an exciting prospect that promises to redefine success in the corporate world.